Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Warren Buffett, known as the “Oracle of Omaha,” is a renowned American businessman, investor, and philanthropist. He is the co-founder, chairman, and CEO of Berkshire Hathaway, a conglomerate that owns various companies such as Geico, Duracell, and Dairy Queen. Buffett, born on August 30, 1930, in Omaha, Nebraska, has had a remarkable journey in the world of finance and investing.

Warren Buffett’s interest in business and investing began at a young age. He made his first stock purchase at 11 and filed taxes at 13. Buffett’s investment philosophy was influenced by Benjamin Graham, and he later graduated from Columbia Business School. In 1956, he founded Buffett Partnership Ltd., which eventually took over Berkshire Hathaway, a textile manufacturing company.

Buffett’s success as an investor led him to become the chairman and majority shareholder of Berkshire Hathaway in 1970. Over the years, he has been known for his adherence to value investing principles and his frugality despite his immense wealth.

Since the 1970s, Buffett has played a significant role in shaping Berkshire Hathaway into one of the leading corporate conglomerates globally. He is often referred to as the “Oracle” or “Sage” of Omaha due to his investment acumen. Buffett has pledged to donate over 99% of his wealth to philanthropic causes, primarily through the Bill & Melinda Gates Foundation.

In 2010, Buffett and Bill Gates launched the Giving Pledge, encouraging billionaires to commit to donating a significant portion of their fortunes to charity. Buffett’s philanthropic efforts have made a substantial impact, with donations exceeding $56 billion as of 2024.

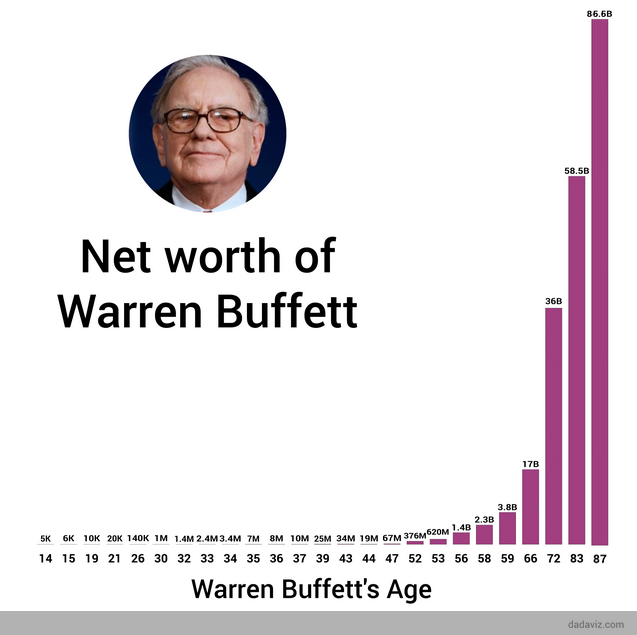

As of March 2024, Warren Buffett’s net worth is estimated to be $134 billion, making him the seventh-richest person in the world. Buffett’s investment portfolio includes holdings in companies like Coca-Cola and IBM, among others. Despite facing challenges during the 2007-08 financial crisis, Buffett’s strategic investments have yielded significant returns over the years.

Buffett’s investment in Berkshire Hathaway, along with acquisitions like Burlington Northern Santa Fe Corp., has contributed to the growth of his wealth and the company’s market capitalization. His investment decisions and long-term approach to investing have solidified his reputation as a legendary investor.

As of 2024, Warren Buffett’s net worth is estimated to be $134 billion, making him one of the wealthiest individuals globally.

Warren Buffett’s interest in investing began at a young age, influenced by his father and renowned investor Benjamin Graham. He founded Buffett Partnership Ltd. in 1956, which later took over Berkshire Hathaway.

The Giving Pledge, launched by Warren Buffett and Bill Gates in 2010, encourages billionaires to commit to donating a significant portion of their wealth to charitable causes.

Warren Buffett’s investment portfolio includes holdings in companies like Coca-Cola, IBM, and Berkshire Hathaway. His strategic investments have yielded substantial returns over the years.

Warren Buffett has pledged to donate over 99% of his wealth to philanthropic causes, with donations exceeding $56 billion. His philanthropic efforts, primarily through the Gates Foundation, have made a significant impact on various charitable initiatives.