Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

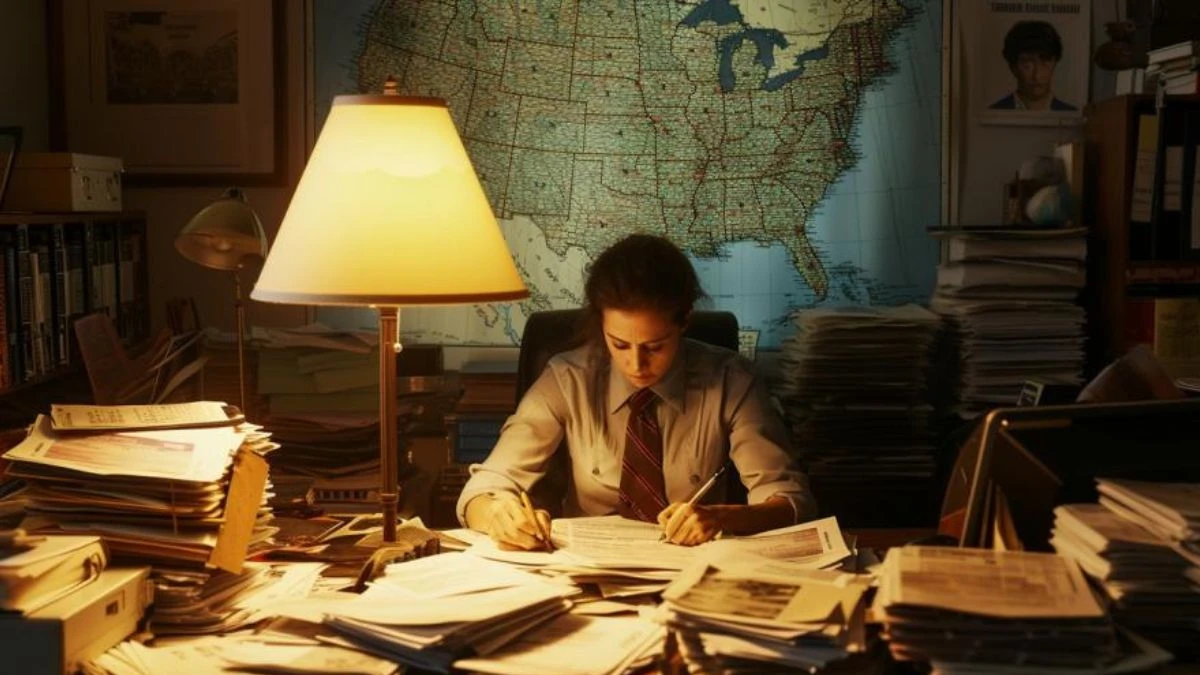

Taxes can differ for people in different states due to varying rules on income tax, residency, and deductions, requiring individuals to adapt their tax strategies accordingly for accurate filing.

Updated Feb 08, 2024

Taxes can differ for people in different states due to varying rules on income tax, residency, and deductions, requiring individuals to adapt their tax strategies accordingly for accurate filing.

The preparation of taxes differs for individuals residing in different states due to varying state tax laws and regulations, influencing factors like income tax rates, residency rules, and available deductions and credits. Residency status, determined by criteria such as the duration spent in a state, plays a pivotal role in shaping tax obligations. Additionally, state-specific exemptions and variations in property and sales taxes contribute to the distinct tax landscape, requiring residents to tailor their tax planning strategies accordingly.