Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Contents

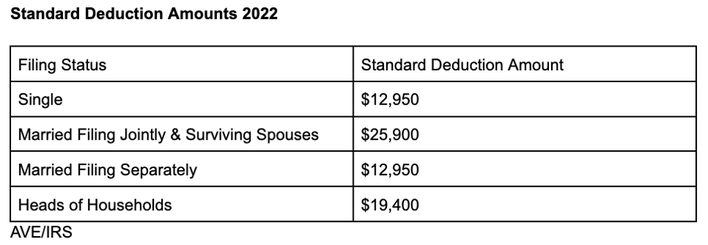

As of 2024, taxpayers who do not itemize deductions on Form 1040, Schedule A, can benefit from the standard deduction. The standard deduction amounts for 2022 have seen an increase compared to the previous year. For married couples filing jointly or qualifying surviving spouses, the standard deduction is set at $25,900, which is an $800 increase from the prior year. Single taxpayers and married individuals filing separately can now enjoy a standard deduction of $12,950 for 2022, up by $400. For heads of households, the standard deduction has risen to $19,400 for the tax year 2022, marking a $600 increase.

For taxpayers who are 65 and older or are blind, there are additional standard deduction amounts for the year 2022. Single individuals or heads of households who fall into this category can claim an extra $1,850, which is a $100 increase from the previous year. Married taxpayers or qualifying surviving spouses can benefit from an additional $1,500 standard deduction, also up by $100.

The Internal Revenue Service (IRS) has announced the tax year 2022 annual inflation adjustments for various tax provisions, including tax rate schedules and other changes. These adjustments are applicable to tax returns filed in 2024. Here are some key highlights of the changes:

For the tax year 2022, the standard deduction for married couples filing jointly has increased to $25,900, up by $800 from the previous year. Single taxpayers and married individuals filing separately can now claim a standard deduction of $12,950 for 2022, marking a $400 increase. Heads of households will see their standard deduction rise to $19,400 for the tax year 2022, up by $600.

For tax year 2022, the top tax rate remains at 37% for individual single taxpayers with incomes exceeding $539,900 ($647,850 for married couples filing jointly). The marginal rates for other income brackets have also been adjusted accordingly.

The personal exemption for tax year 2022 remains at 0, as it was for 2021, due to a provision in the Tax Cuts and Jobs Act. This act has eliminated the personal exemption, impacting how taxable income is calculated.

Looking ahead, the standard deduction amounts for 2024 and 2024 have been outlined by the IRS. For 2024, the standard deduction for single filers and married individuals filing separately is set at $13,850, while married couples filing jointly or qualifying widow(er)s can claim $27,700. Head of households have a standard deduction of $20,800 for 2024. In 2024, these standard deduction amounts will see a slight increase, with single filers and married individuals filing separately having a standard deduction of $14,600, and married couples filing jointly or qualifying widow(er)s claiming $29,200. Head of households will have a standard deduction of $21,900 for 2024.

The standard deduction you are eligible for depends on various factors such as your filing status, age, and whether you can be claimed as a dependent on someone else’s tax return. The IRS adjusts the standard deduction annually for inflation, leading to changes in the deduction amount each year.

There are additional standard deduction amounts for individuals who are 65 and older or blind. For the tax year 2022, single individuals or heads of households who meet these criteria can claim an extra $1,850, while married taxpayers or qualifying surviving spouses can benefit from an additional $1,500 standard deduction. These extra deductions provide further tax benefits for eligible individuals.

Deciding whether to take the standard deduction or itemize your deductions is an important aspect of preparing your federal income tax return. While most taxpayers opt for the standard deduction due to its simplicity and fixed amount, itemized deductions can sometimes result in greater tax savings. Factors such as homeownership, charitable contributions, and medical expenses can influence whether itemizing deductions is more beneficial for you.

The standard deduction is adjusted annually for inflation, leading to changes in the deduction amount each year. The Tax Cuts and Jobs Act made significant changes to the standard deduction in 2017, nearly doubling the deduction amount. While these provisions are set to expire in 2025, future adjustments to the standard deduction will depend on legislative changes and economic factors.

Understanding the standard deduction for each tax year and considering whether to itemize deductions are crucial steps in managing your tax liability and maximizing potential savings. Consulting a tax advisor can provide valuable insights into the best approach for your specific financial situation.