Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Contents

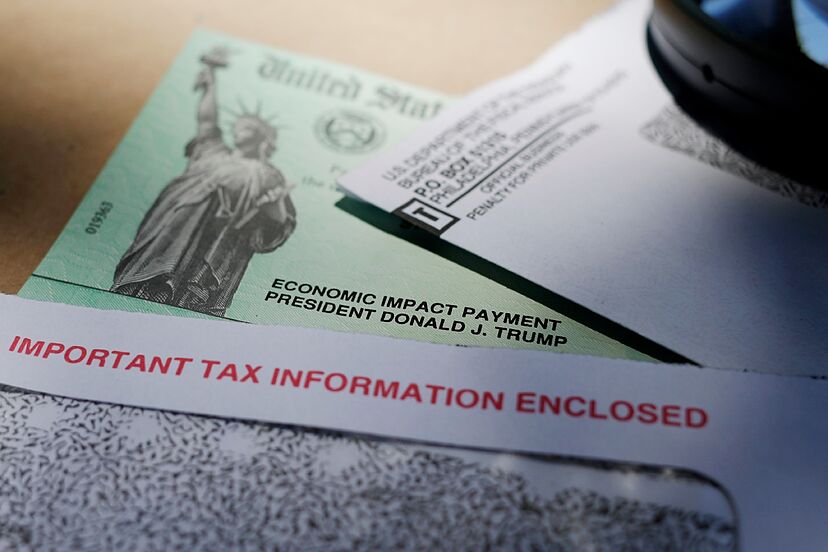

As the economic repercussions of the pandemic continue, many Americans are eagerly anticipating the release of a fourth stimulus check under the American Rescue Plan. This financial aid aims to support those hit hardest by the economic downturn. The Internal Revenue Service (IRS) has been at the forefront, ensuring timely distribution of the payments to eligible citizens.

The anticipation for the 4th stimulus check has grown, especially among those who found the previous payments vital in managing their household expenses during these challenging times. Here, we provide a detailed look into the expected release dates, eligibility criteria, and the process of direct deposit for the upcoming stimulus check.

As of the latest updates, the federal government has not officially confirmed the issuance of a fourth stimulus check. Discussions and proposals have been made, but no definitive action has been taken yet. The IRS, which is responsible for processing and disbursing these payments, has successfully managed three rounds of stimulus checks since the onset of the pandemic.

Despite rumors and speculative reports circulating online, it is crucial to rely on official sources for the most accurate and up-to-date information regarding the 4th stimulus check. As of now, the IRS continues to process returns and manage “plus-up” payments for those eligible for additional amounts based on their 2020 tax returns.

The eligibility criteria for the potential 4th stimulus check are expected to be similar to previous rounds. This means that individuals with an Adjusted Gross Income (AGI) up to $75,000 and couples with an AGI up to $150,000 would likely qualify for full payments. The payment amount is anticipated to phase out for higher income levels, with no payments for individuals earning above $80,000 and couples above $160,000.

Dependents could also play a significant role in the amount received by families. Similar to earlier payments, each dependent could increase the total household stimulus amount, potentially providing additional financial relief to families with children or other dependents.

Direct deposit remains the fastest and most secure method of receiving stimulus payments. The IRS has enhanced its systems to handle an increased volume of direct deposits compared to previous rounds. For those who have previously set up direct deposit with the IRS, payments are expected to be processed swiftly once the program commences.

For recipients who do not have direct deposit information on file with the IRS, paper checks or prepaid debit cards will be mailed. This process may take longer, so it is advisable for individuals to update their banking information with the IRS through the “Get My Payment” tool available on the IRS website.

The IRS provides the “Get My Payment” tool, which allows individuals to check the status of their stimulus payments. By entering their Social Security number, date of birth, and address, users can view the scheduled date for their payment and whether it will be sent via direct deposit or mail.

This tool is updated once per day and can provide peace of mind for those anxious about the status of their payments. It is an essential resource for personal financial planning during these uncertain times.

Q1: When is the 4th stimulus check expected to be released?

A: As of now, there is no official release date since the federal government has not confirmed the issuance of a fourth stimulus check.

Q2: Who qualifies for the 4th stimulus check?

A: If approved, the eligibility criteria are expected to mirror previous rounds, focusing on individuals and families with specific income thresholds and including additional payments for dependents.

Q3: How can I ensure I receive my payment quickly?

A: Setting up or updating your direct deposit information with the IRS is the most efficient way to receive your stimulus payment promptly.

Q4: Can I track my stimulus payment?

A: Yes, the IRS’s “Get My Payment” tool allows you to track the status of your stimulus check.

Q5: What should I do if I didn’t receive a previous stimulus check?

A: You may be eligible to claim missing payments through the Recovery Rebate Credit on your tax return.

Q6: Will there be additional stimulus payments in the future?

A: The possibility of future payments depends on legislative actions and the economic impact of the ongoing pandemic. It is essential to stay updated through official channels.