Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

What is Average Net Worth By Age?

Understanding how your financial standing compares to others in your age group can provide valuable insights into your financial health. Net worth, which is calculated by subtracting your liabilities from your assets, offers a snapshot of your current financial position. While it’s tempting to compare yourself to high-profile billionaires like Elon Musk or Oprah Winfrey, looking at average net worth figures by age can give you a more realistic benchmark.

Average American Net Worth

The Federal Reserve Board’s Survey of Consumer Finances, conducted every three years, provides data on family incomes, net worth, and more. As of the most recent report released in October 2024, the overall mean net worth of U.S. households is approximately $1.06 million. However, looking at the median net worth, which is $192,900, gives a more accurate representation of the typical American’s financial situation.

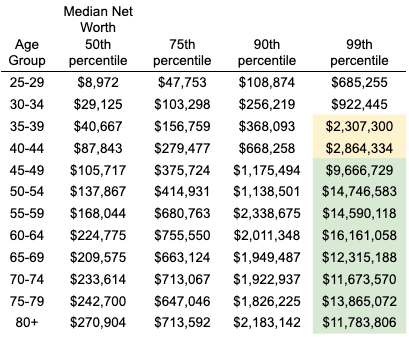

Average Net Worth by Age Group

Net worth varies based on factors like education, income, and age. Here’s a breakdown of the median and average net worth figures for different age groups:

Less than 35:

– Median net worth: $39,000

– Average net worth: $183,500

35-44:

– Median net worth: $135,600

– Average net worth: $549,600

45-54:

– Median net worth: $247,200

– Average net worth: $975,800

55-64:

– Median net worth: $364,500

– Average net worth: $1,566,900

65-74:

– Median net worth: $409,900

– Average net worth: $1,794,600

75+:

– Median net worth: $335,600

– Average net worth: $1,624,100

Calculating Your Net Worth

To calculate your net worth, list all your assets (such as savings, investments, and real estate) and liabilities (like mortgages and loans), then subtract your total liabilities from your total assets. Regularly tracking your net worth can help you monitor your financial progress, set goals, and make informed financial decisions.

Building Net Worth Over Time

Building net worth is a gradual process that evolves throughout your life. In your 20s, focus on establishing good financial habits. In your 30s, prioritize saving and investing. During your 40s, avoid lifestyle inflation to boost net worth. In your 50s and 60s, maximize retirement contributions and pay down debt. And in your 70s and beyond, focus on budgeting and portfolio withdrawal strategies.

Net Worth Comparison by Age

Comparing your net worth to others in your age group can serve as motivation to improve your financial situation. While average net worth provides an overview of collective wealth, median net worth offers a more accurate representation of typical financial status. By understanding where you stand financially, you can make informed decisions to enhance your net worth over time.

FAQs

1. How often should I calculate my net worth?

It’s recommended to calculate your net worth at least once a year to track your financial progress and make adjustments to your financial plan.

2. What factors can impact my net worth?

Factors like income, expenses, investments, debts, and inheritances can influence your net worth over time.

3. Is it normal for net worth to fluctuate?

Yes, net worth can fluctuate due to changes in asset values, debt levels, income, and expenses. It’s essential to monitor these fluctuations and adjust your financial strategy accordingly.

4. How can I increase my net worth?

To boost your net worth, focus on saving, investing wisely, paying down debts, and controlling expenses. Consistent financial discipline and long-term planning can help increase your net worth over time.

5. Why is it important to track my net worth?

Tracking your net worth allows you to assess your financial health, set goals, and make informed financial decisions. It provides a comprehensive view of your financial situation and helps you plan for the future.