Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Contents

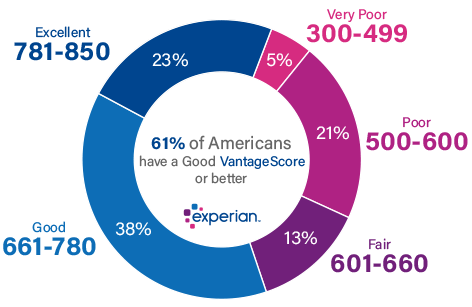

A credit score is a crucial factor that lenders consider when deciding whether to offer you credit, such as a loan or credit card. It is a three-digit number that typically ranges from 300 to 850. Your credit score is calculated using information from your credit report, including your payment history, the amount of debt you have, and the length of your credit history. Different lenders may have varying criteria for granting credit, so it’s essential to understand what is considered a good credit score.

Generally, credit scores from 580 to 669 are considered fair, 670 to 739 are considered good, 740 to 799 are considered very good, and 800 and above are considered excellent. Lenders typically view individuals with credit scores of 670 and above as lower-risk borrowers, making it easier for them to qualify for credit with better terms. On the other hand, individuals with credit scores below 580 may find it challenging to qualify for credit or secure favorable loan terms.

Having a good credit score demonstrates responsible credit behavior, which can instill confidence in lenders when evaluating your credit application. Achieving a good credit score can help you qualify for credit cards or loans with lower interest rates and better terms, ultimately saving you money in the long run.

Several key behaviors can impact your credit score, including:

By following these behaviors and maintaining good credit habits, you can work towards achieving and maintaining a good credit score.

Holding a good credit score can significantly benefit you in various financial aspects. It can increase your chances of qualifying for loans, credit cards, or mortgages with favorable terms and lower interest rates. A good credit score can save you money over time by reducing the cost of borrowing.

Moreover, a good credit score can impact non-lending decisions, such as renting an apartment or securing insurance. Landlords and insurance companies may review your credit reports to assess your financial responsibility and reliability.

If you aim to enhance your credit score, consider the following steps:

Improving your credit score requires consistent effort and responsible financial behavior. By focusing on these key factors, you can work towards achieving a good credit score and reaping the benefits associated with it.