Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Calculating your net worth is an essential step in understanding your financial health. It provides a clear picture of where you stand financially by taking into account your assets and liabilities. Net worth is a crucial metric used by individuals, corporations, and even countries to assess their financial standing. In this article, we will delve into the details of how to calculate net worth and why it is important.

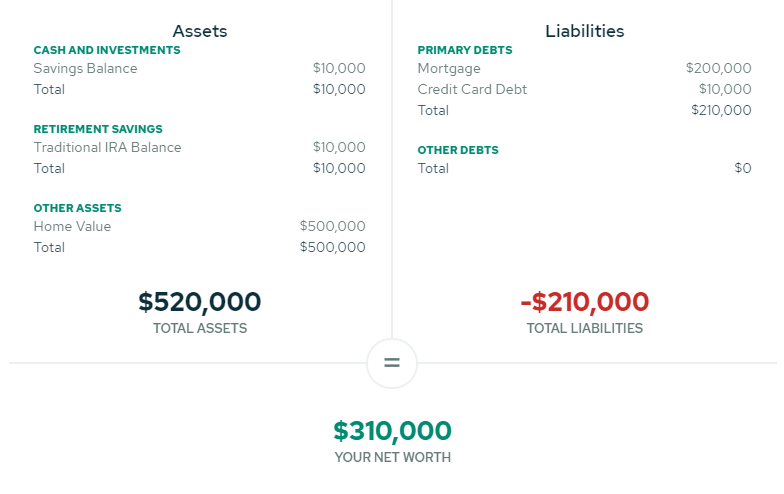

Assets are valuable possessions that you own, such as cash, retirement accounts, investment accounts, vehicles, and real estate. On the other hand, liabilities are financial obligations or debts that you owe, including credit card debt, student loans, mortgages, and auto loans. To calculate your net worth, you need to subtract your total liabilities from your total assets.

For example, if you own a house worth $300,000, have $50,000 in savings, and owe $100,000 on a mortgage and $10,000 on a car loan, your net worth would be calculated as follows: ($300,000 + $50,000) – ($100,000 + $10,000) = $240,000.

A positive net worth indicates that your assets exceed your liabilities, reflecting good financial health. Conversely, a negative net worth occurs when your total liabilities surpass your total assets. This situation calls for a focus on reducing debts and improving your financial position.

It is essential to track changes in your net worth over time to ensure that you are making progress towards your financial goals. By increasing your assets or reducing your liabilities, you can enhance your net worth and secure a stronger financial future.

In business, net worth is also known as book value or shareholders’ equity. Lenders assess a company’s net worth to evaluate its financial stability and repayment capacity. For individuals, net worth includes assets like savings, investments, and real estate, minus liabilities such as debts and loans.

High net worth individuals (HNWIs) are those with substantial assets, making them prime candidates for wealth management services. Understanding your net worth can help you make informed financial decisions and plan for the future.

Net worth is determined by subtracting liabilities from assets, including cash, investments, real estate, and personal possessions.

It is recommended to calculate your net worth regularly, such as quarterly or annually, to track your financial progress.

Yes, a negative net worth occurs when liabilities exceed assets. It signifies a need to focus on reducing debts and improving financial stability.

Monitoring net worth helps individuals and businesses assess their financial health, set goals, and make informed financial decisions.

To boost your net worth, you can focus on increasing your assets through investments, savings, and property ownership, while also reducing liabilities by paying off debts.

Net worth serves as a key metric in financial planning, guiding individuals and businesses in managing their resources, setting financial goals, and building wealth over time.