Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Contents

Net worth is a crucial financial metric that reflects an individual’s wealth accumulation over time. It is calculated by subtracting all liabilities from assets, providing a comprehensive view of one’s financial health. Understanding how net worth varies by age can offer valuable insights into financial planning and goal setting.

Net worth is determined by subtracting debts from assets, encompassing various financial components like savings, investments, real estate, and more. It serves as a key indicator of financial stability and can guide individuals in managing their money effectively. Tracking net worth over time offers a clear picture of financial progress and areas for improvement.

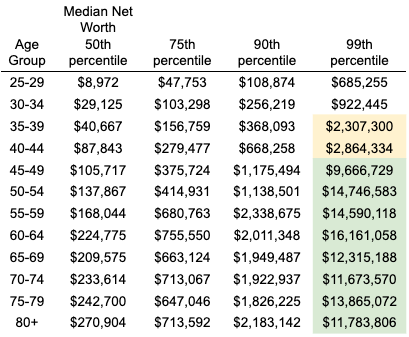

Net worth figures vary significantly across different age brackets, influenced by factors such as income, education, and financial habits. Here is a breakdown of average and median net worth by age groups:

Building net worth is a gradual process that evolves throughout an individual’s life stages. From establishing financial habits in one’s 20s to maximizing retirement savings in later years, each decade presents unique opportunities for wealth accumulation. By prioritizing saving, investing wisely, and managing debt, individuals can enhance their net worth over time.

Increasing net worth requires a strategic approach and consistent financial discipline. Here are some effective strategies to boost net worth:

Setting up automatic transfers to savings or retirement accounts ensures regular contributions without the need for manual intervention. As income grows, increasing the amount allocated to savings can accelerate wealth accumulation.

Prioritize paying off high-interest debts, such as credit card balances, to reduce financial liabilities. Monitoring expenses and cutting back on unnecessary spending can free up funds for savings and investments, ultimately enhancing net worth.

During peak earning years, maximizing contributions to retirement accounts like IRAs and 401(k)s can significantly impact long-term net worth. Taking advantage of employer matches and tax benefits can further boost retirement savings.

1. How is net worth calculated?

Net worth is calculated by subtracting total liabilities from assets, providing a comprehensive view of an individual’s financial standing.

2. Why is net worth important?

Net worth serves as a key indicator of financial health, helping individuals assess their wealth accumulation and make informed financial decisions.

3. How does net worth vary by age?

Net worth typically increases with age as individuals progress in their careers, save for retirement, and accumulate assets over time.

4. What are effective strategies for building net worth?

Strategies such as automating savings, managing debt, and maximizing retirement contributions can aid in building net worth steadily over the years.

5. How can individuals track their net worth progress?

Utilizing online tools, such as net worth calculators and financial apps, can help individuals track their assets, liabilities, and overall net worth growth over time.