Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Contents

The Child Tax Credit is a valuable tool that assists families with qualifying children in obtaining a tax break. This credit can be claimed even if you do not typically file a tax return. To qualify for the Child Tax Credit for the 2024 tax year, certain criteria must be met:

To qualify for the full amount of the 2024 Child Tax Credit for each qualifying child, you must meet all eligibility factors, and your annual income should not exceed $200,000 ($400,000 if filing a joint return). Parents and guardians with higher incomes may still be eligible to claim a partial credit. It is recommended to use the Interactive Tax Assistant to determine eligibility for the Child Tax Credit.

To claim the Child Tax Credit for 2024, you need to enter your children and other dependents on Form 1040, U.S. Individual Income Tax Return, and attach a completed Schedule 8812, Credits for Qualifying Children and Other Dependents. In case of an audit or denial of your claim, the IRS provides guidance on what steps to take, including how to claim the credit if it was denied in the past.

Aside from the Child Tax Credit, families who qualify may also be eligible for additional tax credits such as the Child and Dependent Care Credit, Earned Income Tax Credit, Adoption Credit and Adoption Assistance Programs, and Education credits. Families may also qualify for the Credit for Other Dependents for a child or dependent who does not meet the criteria for the Child Tax Credit.

For the 2024 tax year, there have been changes to various tax credits and deductions. The standard deduction amount has increased for all filers, with different amounts based on filing status. The maximum additional child tax credit amount has also increased to $1,600 for each qualifying child. However, many changes to the Child Tax Credit that were implemented by the American Rescue Plan Act of 2021 have expired.

Under current law for 2024, the initial amount of the Child Tax Credit is $2,000 for each qualifying child. The credit amount begins to phase out when adjusted gross income exceeds $200,000 ($400,000 for joint filers). The amount of the Child Tax Credit that can be claimed as a refundable credit is limited, with the maximum Additional Child Tax Credit amount for each qualifying child increased to $1,500.

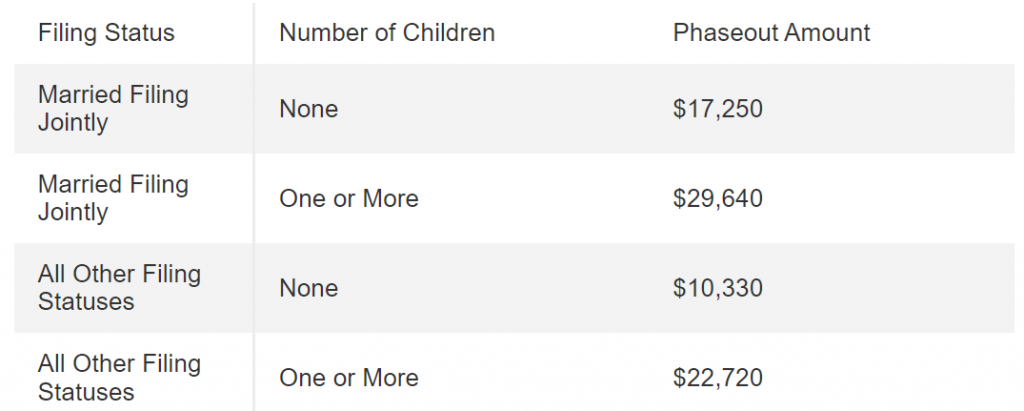

Changes have also been made to the Earned Income Tax Credit (EITC) for 2024, with enhancements for taxpayers without a qualifying child implemented by the American Rescue Plan Act of 2021 no longer applying. Taxpayers can find more information on Child Tax Credits in the Instructions for Schedule 8812 (Form 1040).

Another notable change for 2024 is the credit for new qualified plug-in electric drive motor vehicles, now known as the Clean Vehicle Credit. The maximum amount of the credit and some requirements to claim the credit have been modified. Taxpayers can find more information on these and other credit and deduction changes for 2024 in the Publication 17, Your Federal Income Tax (For Individuals) taxpayer guide.

Additionally, the IRS has announced that the 1099-K reporting requirements for tax year 2024 remain unchanged. Taxpayers who receive payments through credit, debit, or gift cards for selling goods or providing services may receive a Form 1099-K from their payment processor. It is essential to understand what is taxable and what is not, as well as the importance of good recordkeeping to facilitate tax return filing.

The tax deadline for most Americans for the 2024 tax season is April 15, 2024. However, individuals in Maine or Massachusetts have until April 17, 2024, to file due to official holidays observed in those states. Taxpayers are advised to wait until they have received all necessary tax documents before filing their returns to avoid potential mistakes and delays.

For those with income below the standard deduction threshold for 2024, filing a return may still be beneficial as it could result in a refund. Over-withholding and eligibility for tax credits like the Earned Income Tax Credit and Child Tax Credit should be considered when deciding whether to file a return.

There are various ways to file taxes for free, including in-person full-service tax preparation services through programs like the IRS Volunteer Income Tax Assistance (VITA) and AARP Foundation Tax-Aide. Remote full-service tax preparation and free self-preparation options are also available for eligible individuals. Additionally, servicemembers can utilize MilTax for free tax filing services.

Before opting for a fee-based tax preparer, taxpayers should consider the complexity of their return and explore free filing options. It is essential to check the preparer’s qualifications, history, and service fees before proceeding. Understanding refund anticipation checks and refund advance loans can help taxpayers make informed decisions about their tax refunds.

As the 2024 tax season progresses, taxpayers should stay informed about changes to tax credits, deductions, and filing requirements. Utilizing free tax filing options and understanding eligibility for various credits can help individuals and families maximize their tax refunds and comply with IRS regulations.