Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Contents

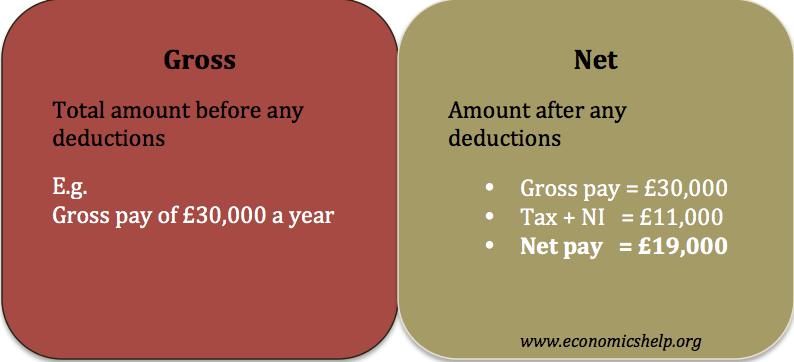

When it comes to payroll, understanding the distinction between gross pay and net pay is crucial for both employers and employees. Gross pay refers to the total amount an employee earns before any deductions are taken out, while net pay, also known as take-home pay, is the amount that an employee actually receives after all deductions have been accounted for. Let’s delve deeper into the differences between these two key components of an employee’s compensation.

Gross pay encompasses the total earnings of an employee before any deductions are subtracted. This includes the employee’s base salary or hourly wage, as well as any additional components such as bonuses, commissions, reimbursements, and overtime pay. Employers often use gross pay as a benchmark when discussing compensation with employees.

Calculating gross pay varies depending on whether the employee is salaried or hourly. For salaried employees, gross pay is determined by dividing their annual salary by the number of pay periods in a year. On the other hand, for hourly workers, gross pay is calculated by multiplying the hourly rate by the number of hours worked during a pay period, accounting for any overtime rates if applicable.

Net pay, or take-home pay, is the amount that an employee receives after all deductions have been withheld from their gross pay. These deductions can include federal and state income taxes, Social Security and Medicare taxes, health insurance premiums, retirement contributions, wage garnishments, and other voluntary or mandatory deductions.

Calculating net pay involves starting with the gross pay based on the employee’s hours worked or salary divided by the number of pay periods, and then subtracting all applicable deductions to arrive at the final net pay amount that the employee takes home.

The primary distinction between gross pay and net pay lies in the deductions that are factored into each figure:

Understanding the difference between gross pay and net pay is essential for both employers and employees to ensure transparency and accuracy in payroll processes. While gross pay reflects the total compensation earned by an employee, net pay indicates the actual amount they take home after deductions. By grasping these concepts, employers can effectively manage payroll operations, while employees can have a clear understanding of their earnings and deductions.