Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Contents

When it comes to Social Security benefits, understanding the maximum amount you can receive is crucial for retirement planning. The maximum benefit you can receive depends on various factors, including the age at which you choose to retire. Let’s delve into what the maximum Social Security benefit entails and how it is calculated.

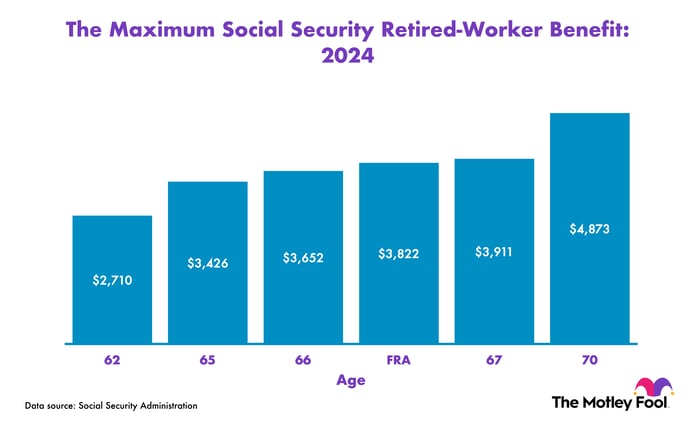

As of 2024, the maximum Social Security benefit varies depending on the age at which you retire. Here is a breakdown of the maximum benefits based on different retirement ages:

It’s important to note that the full retirement age is gradually increasing for those born after a certain year, impacting the maximum benefit amount.

To be eligible for the maximum Social Security benefit, individuals must have had earnings that meet or exceed Social Security’s maximum taxable income for at least 35 years of their working lives. The maximum taxable income in 2024 is $168,600, with this figure being adjusted annually based on national wage levels.

Individuals who have consistently earned at or above the maximum taxable income threshold are likely to qualify for the maximum benefit when they retire.

It’s essential to differentiate between the maximum individual benefit and the maximum family benefit. The maximum family benefit refers to the total amount that a family can receive from Social Security based on one family member’s earnings record. This includes various benefits such as retirement, spousal, children’s, disability, or survivor benefits.

While an individual may be eligible for the maximum individual benefit based on their earnings history, the maximum family benefit considers the total benefits that can be paid out to a family unit.

Several factors can impact the actual benefit amount an individual receives, including the age at which they choose to start receiving benefits. Starting benefits early, before reaching full retirement age, can result in a reduction in the monthly benefit amount. On the other hand, delaying benefits beyond full retirement age can lead to an increase in the benefit amount.

It’s crucial for individuals to consider these factors and plan their retirement strategy accordingly to maximize their Social Security benefits.

Understanding the maximum Social Security benefit and the factors that influence it is key to effective retirement planning. By knowing the maximum benefit amount based on retirement age, eligibility criteria, and the impact of early or delayed retirement, individuals can make informed decisions to secure their financial future during retirement.